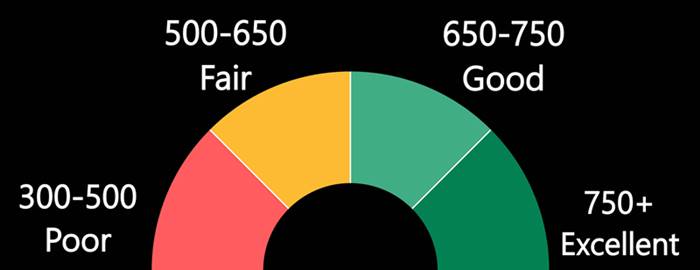

A credit score of 600 or lower can prove to be a major obstacle in obtaining what you desire. It may be difficult to obtain an apartment loan or a mortgage based solely on your credit score. Or, it might prove difficult to find the best credit card for you. There are many options for those with low credit scores.

Getting a credit card with a 600 credit score

You might wonder if you are eligible for a credit card if your credit score is less than 600. There are many options. Many providers are happy to help people with credit scores between 600 - 650. The application process is simple and painless.

A student or no-fee credit card might be the best option depending on your score. Secured credit cards are also available to help you rebuild your credit. Here are some of the top credit cards for people with 600 credit scores:

Refinance your car loan with a 600 Credit Score

Low credit score buyers can often get special offers and interest rates from car dealers. These offers range from cash rebates to lower interest rates on new cars loans. Those with a 600 credit score can find better interest rates on a new car than a used car, but you should be aware of the disadvantages of getting a car loan with a low credit score. For the best rates, shop around and get quotes from many loan companies.

Your credit score is a major factor in determining your interest rates and overall cost. You should expect to pay higher interest rates for a car loan if your credit score is between 600 and 700. Aim to raise your credit score by at least 60 points. This could help you save up to $30 per week or $2700 over your loan term.

Secured credit card with 600 credit score

For people with low credit scores, a secured credit card can be a great choice. These cards can be applied for quickly and are relatively inexpensive. A secured credit card with 600 credit scores is generally cheaper than an unsecured one. These cards typically require a security fee equal to the card credit limit. It's also fully refundable if the account is closed with zero balance.

Many banks offer a secured card. Some of these cards are free of charge, and others require a deposit. Many require that you have a banking account. Some allow you the option to fund the security deposit through a wire transfer, money order or money order. Some cards have a cash back program and no annual fee, making them a good option for people with low credit scores.

You can get a revolving card credit card with a 600 credit rating

If you have a 600 credit score and want a credit card, there are some things you need to know. First, although you may struggle to get approved, this doesn't mean you cannot get one. You can apply for a revolving card with low credit scores if you are able to afford the monthly payments.

Revolving credit is costly, so you should be careful when applying for one. Paying high interest rates on your cards can cause your debts to grow quickly. This could lead you to defaults. Rating agencies will examine your credit limit as well as your current balance. Credit card accounts that exceed 30% can reduce your credit score.