It is important to have a strong business credit record if your lender credibility is to be established. There are a few steps you can take to establish a good business credit history. These include opening new business accounts, and keeping track of your score. These steps are crucial to helping you establish your business credit and get the financing you need.

It is vital to establish credit for business in order to build trust with lenders

First, open a checking account for your business. It should be opened at a bank the same as your personal account. A business checking account will make it easier for you to obtain loans and increase your capital access. It is important to get a copy your business credit report. You need to know how it can be interpreted. You should keep an eye on your business credit score, and update it regularly.

Information about your company's registration status will be included in your credit report. Most businesses register with their state governments. You'll need to register in your state if your business is unincorporated or foreign. It is also important to acquire any necessary business or professional licenses. Public information is also used by many commercial credit agencies to assess your business' creditworthiness.

For business credit, opening new accounts

Many lenders offer trade loans to small business owners for equipment purchases and business improvements. These lines of credit are usually subject to high interest rates. Therefore, it is important you have several accounts to help build your business credit. These updates may take several months to reflect on your credit reports.

It is also important to establish a legal entity for your business, either as a sole proprietorship, a corporation, a partnership, or limited liability company. It is important that you obtain a business telephone line. This adds legitimacy to both your business and the government. You can then open business accounts once you have a phone number for your business.

Along with opening a bank account for business, you need to open at least one trading line with a local vendor. These accounts are commonly called "Net 30" accounts. They allow you buy on credit and to pay it later. Tradelines are used to purchase office supplies, electronics, and marketing material. Before you sign up with a tradeline, ask the vendor for information about which credit bureaus it reports to. Otherwise, these tradelines will not help build business credit.

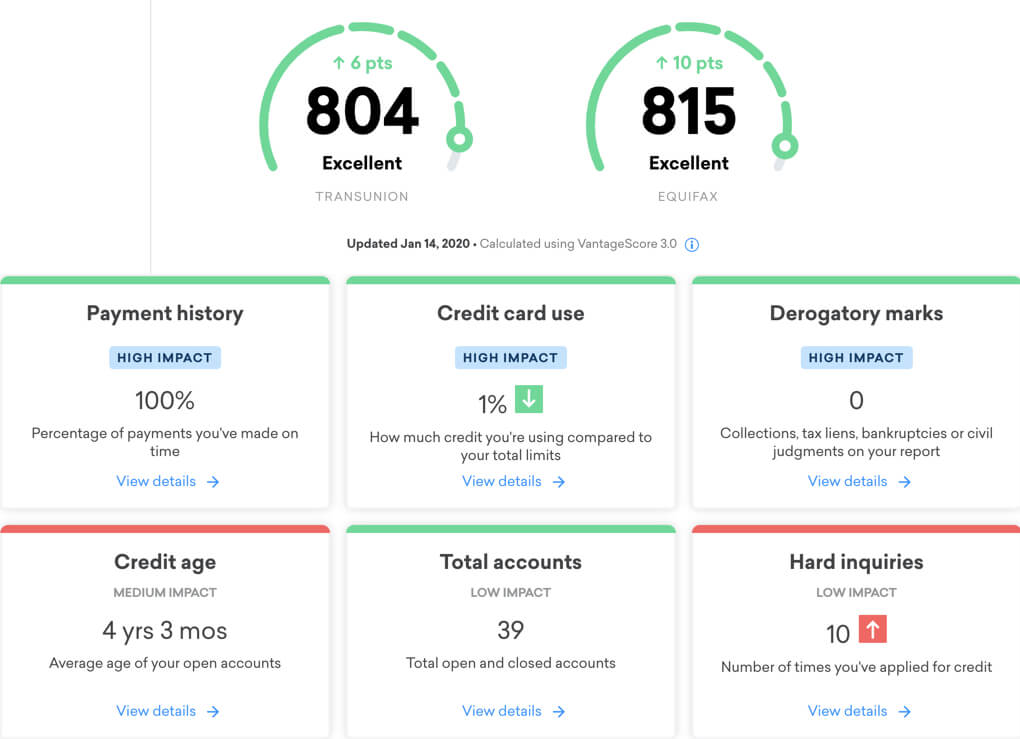

Monitoring your business credit score

Your company should know its credit score. It can help you avoid identity theft and identify unauthorized accounts. It can also help you visualize your business' financial health. It can even help you obtain trade credit and financing you might not be otherwise able to.

Your payment history is the most important factor in determining your business credit score. Despite this, not all lenders base their decisions only on one number. To keep track of your score, it is a good idea to sign up for a credit monitoring service. Bullseye Finance Group sells a package of five reports that includes five different types at an affordable price. Packages include key performance indicator (KPIs), failure scores, as well as risk and failure scores.

Different agencies use different scoring scales. Paydex, for example, calculates your business credit score based upon your payment history and references from vendors. High scores mean that your business is more risky and can be offered better terms.