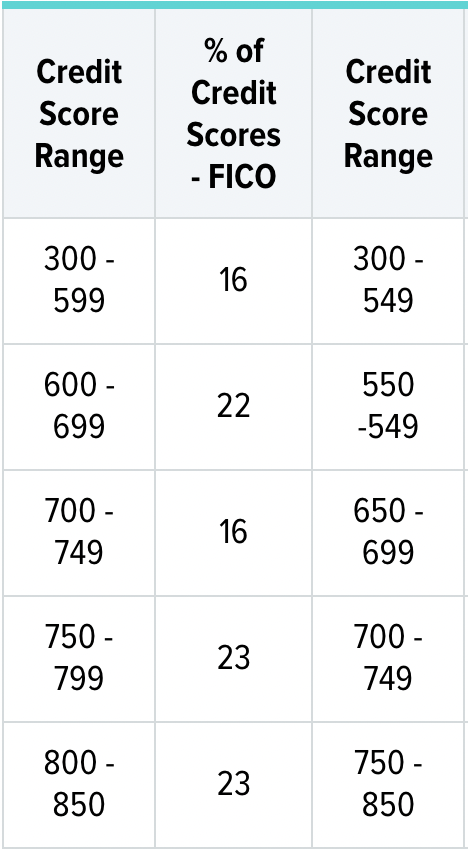

Having a diverse mix of credit lines is essential if you'd like to build your credit score. It's a good idea for you to have at minimum one installment and at least one revolving bank account. It is important to review the credit you have. A thin credit history could mean that you only have limited lines and reporting periods. Even if your payments have been made on time, a thin credit file can result in a low score. This happens because your file may not be complete enough to generate a score.

Diversifying credit

Diversifying credit is an important step towards improving credit scores. Multiple credit accounts will show creditors that your ability to responsibly manage all kinds of loans. Your credit score can be improved by making timely payments and keeping your balances low. You can begin by applying for loans that are lower than your maximum credit limit.

Diversifying one's credit portfolio is similar in concept to learning to play tennis. It can be difficult to convince an experienced tennis coach to give you a spot on their team if your basic knowledge of the game is lacking. But, it's a good idea to demonstrate your ability as a tennis player.

The benefits of diversifying credit are minimal. In most cases, you don't need to open a new line of credit if you don't need it right now. A second credit line is recommended if you need it for unexpected expenses. By doing this, you can take advantage of many bonus offers offered by different credit card companies. It's important to keep in mind that just because you have diversified your credit, doesn't mean that you can't make use of them all.

Impact of installment loans on credit scores

Installment credit is a form of credit where you take out a loan for a specified amount of money and pay it off in regular installments over a specified period. You will have to pay interest and fees in return. These vary depending on how creditworthy you are and what type of installment loan that you take out. Installment credit is beneficial only if you use it responsibly and keep your balance to a minimum. You will have to pay interest on any balance remaining.

It is important that you submit your application for a new installment loan on time. You should give the application at least 14 working days after you submit it. Keep your balance below 30% of your limit if you have any. It is important to make payments on your installment loans every month. This will help your credit score, as it demonstrates responsible debt management.

Credit utilization: Impact of revolving loans

Revolving Credit, also known by a line, can be accessed when you are in need. You can repay any amount used so you can keep using the credit card. This is a way to build strong credit without needing to take out large loans. You can improve your credit score by making timely payments and having a low credit utilization.

Revolving credit is a popular option for consumers seeking to borrow money. This credit allows for easy and flexible access. Consumers can borrow a maximum amount and make monthly payments. If they do not make their minimum payments, the balance is carried over to the next statement period, and interest is charged.