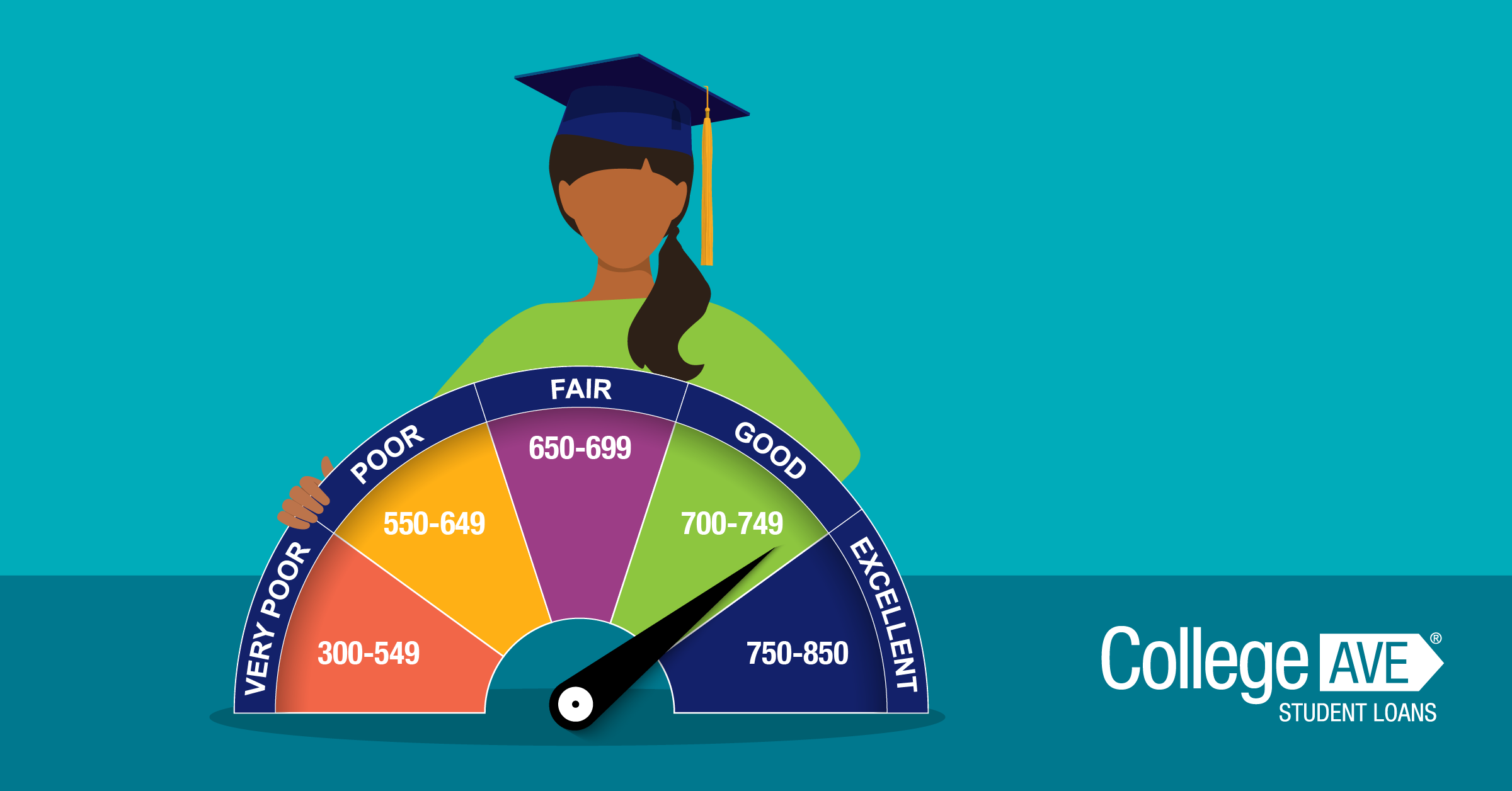

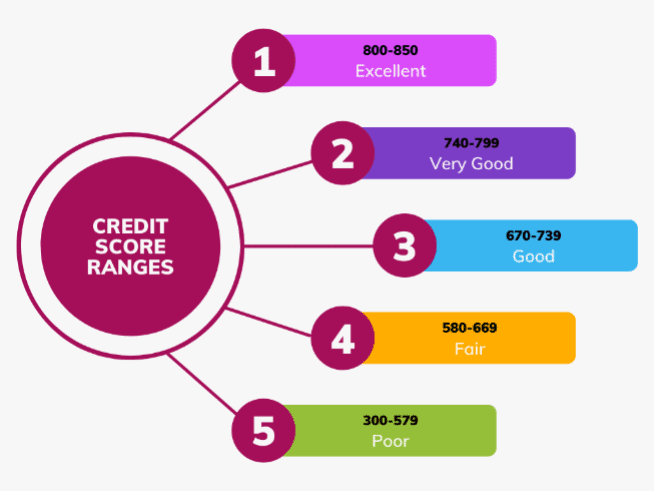

If you're a college student looking to apply for a credit card you must show that you have the funds to pay the minimum credit cards bill. This requires assets and independent income. If your credit is poor or nonexistent, you may want to consider credit cards for students that are designed to help you build credit, such as the Capital One Platinum Secured Credit Card. You can also have a relative with a strong payment history add you to your authorized user list. This will improve the credit rating of the person you are adding to your authorized user account.

Find it Student Cash back

Apply online for the Discover it Cash Back credit cards if your are in school or at work. This card offers 5% cash back on rotating categories. Your card can be personalized with a choice of an animal design or cassette tape. You can choose to have your cash back rate vary depending on which categories you spend most.

The Discover it student cash back credit card has been voted one of the best student cards available. It offers generous cash rewards and a low interest rate and a low annual fee. The card's terms and interface are also quite user-friendly.

Capital One Travel Student Rewards

Capital One Journey Student rewards credit card for students provides cash back on purchases. Earn one cent per dollar and receive an additional 0.25 for on-time payments. If you reach certain thresholds, your points can be used to redeem for a statement credit or a check.

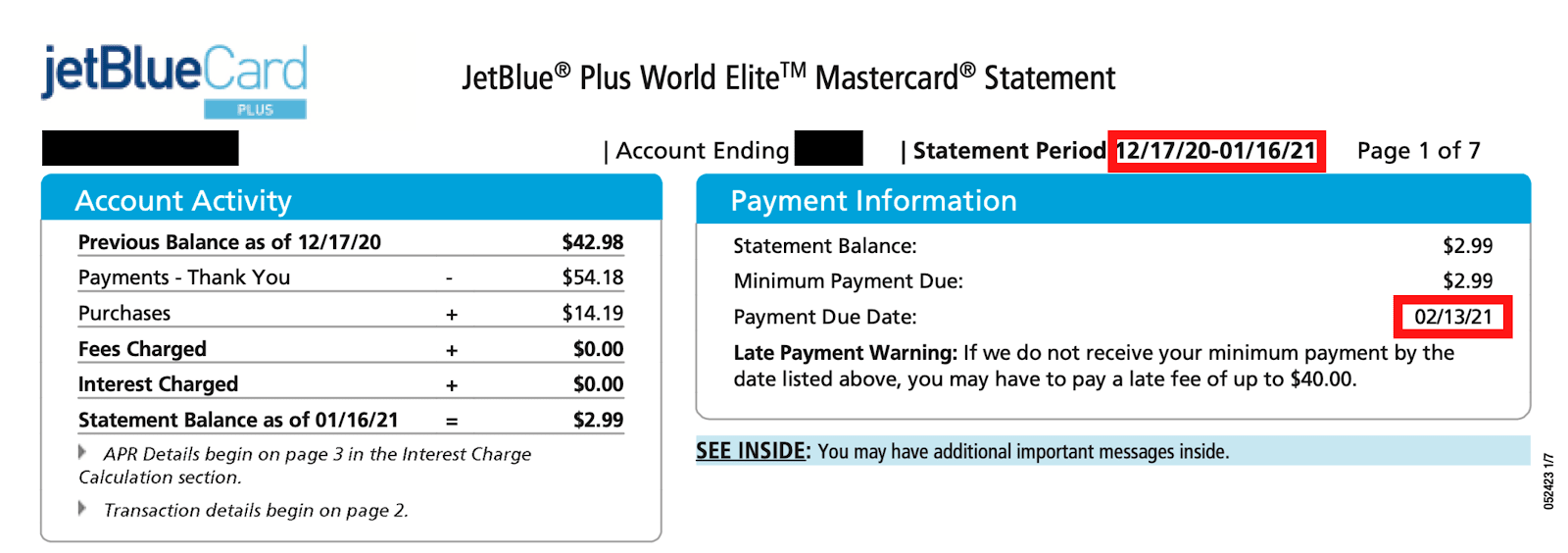

Capital One Journey Student rewards card includes an automatic creditline review. This review begins six months after you open your account. This automatically increases the available credit line over time. This means you won't have to worry about whether you have enough or not enough credit in the near future. Capital One also offers a free credit monitoring program called CreditWise. This service provides easy monitoring of your credit score and alerts you when TransUnion reports are updated.

Discover it Student Credit Cards

The Discover It Student Credit Card offers a great opportunity to get credit history started while at college. This card comes with a number of benefits such as no annual fee or minimum credit score. In addition, there are no late payment fees or foreign transaction fees. It has an excellent rewards programme.

Students love its cash back program, which allows them to receive cash back on select purchases. Qualifying purchases can earn you up to 10% cash back. There is no annual fee and Discover matches any cash back earned in the first year with an additional $20 statement credit.

Discover it Student Secured card

If you are a student, you might want a credit card for students that doesn't have an annual fee and offers lots of rewards. Discover it Student Secured Card provides that. This card offers 2% cash back on gas and 1% on all other purchases. The card also comes with a cashback match. This means that the company will match your cashback after one year. These rewards are generous, and can be used in order to pay tuition or books.

The Discover it Secured credit card has a great balance transfer function. Transfer your balance to an unsecure card without affecting the secured card. This can be done by activating a free mobile app. Be aware of its high APR, as well as the large security deposit. People who cannot pay their bills on time or build a good credit history should not apply for this card.

Learn it Student Visa

The Discover it Student Visa credit cards are available to students. The card comes with a range of benefits for students, including unlimited cashback in the first year. This card is great for people who don’t use credit cards as often but want to improve their credit score.

The credit card comes with no annual fees and cash back for eligible purchases. The card also offers cash back of 5% in rotating categories. A $20 statement credit is available if you score a "B" or better during your first year. Discover cards offer 2% cash back anywhere else and Discover Deals that offer double cashback.