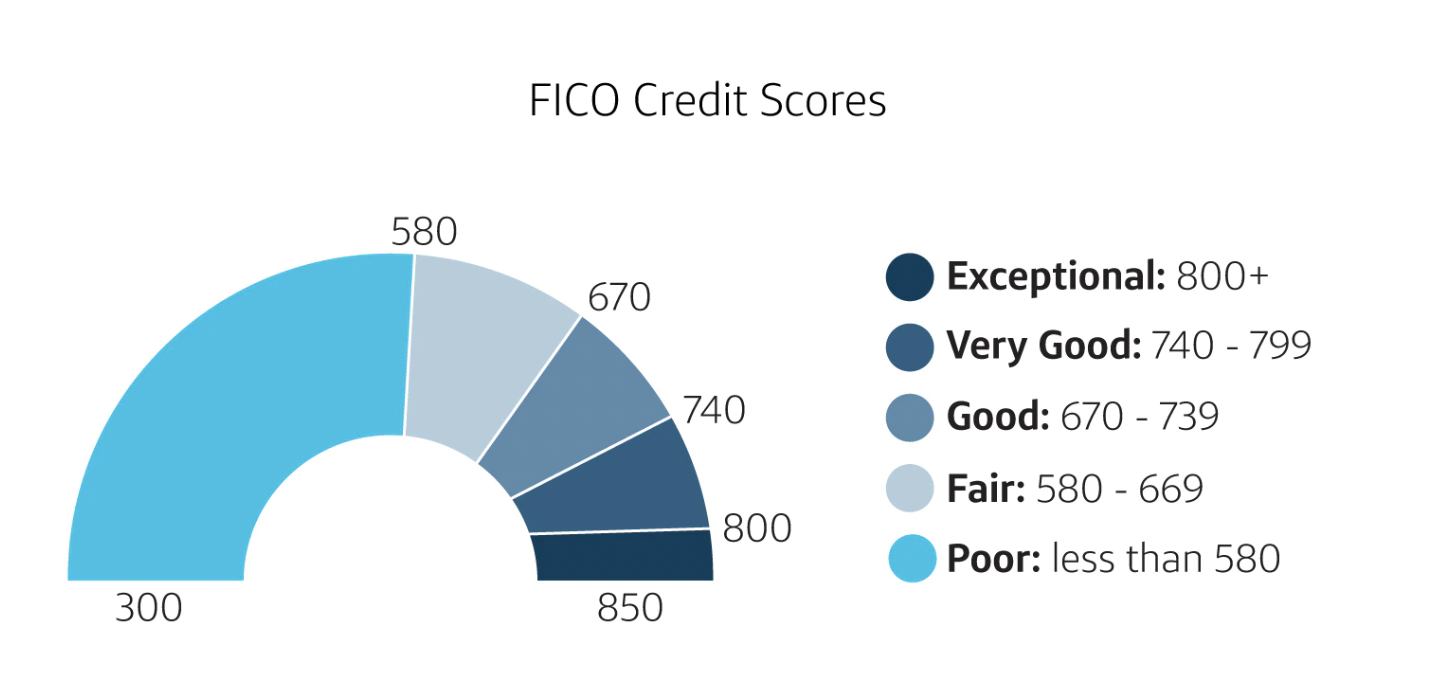

It is important to have a good credit score when you are applying for a loan. It should be 720 or above. Nine out of ten U.S. mortgages can be obtained by borrowers who have scores in the upper half of this range. The average credit score of those in the 50th percentile range is 760.

720+

A score of 720+ or higher can help you secure a better interest rate and borrowing terms if you're looking to mortgage. A credit score of at least 720 is considered "very good". It can help qualify you for a mortgage with an interest rate lower than a credit score of 620. It can also help with your eligibility for top credit cards with low rates of interest.

For mortgage lenders, borrowers with good credit histories and debt management are preferred. A credit score of at least 720+ will help mortgage lenders evaluate your credit risk and give you the lowest interest rate. A credit score higher than 720 is considered excellent by the lending sector, while a credit rating of 760+ will help you get the best mortgage rates.

760+

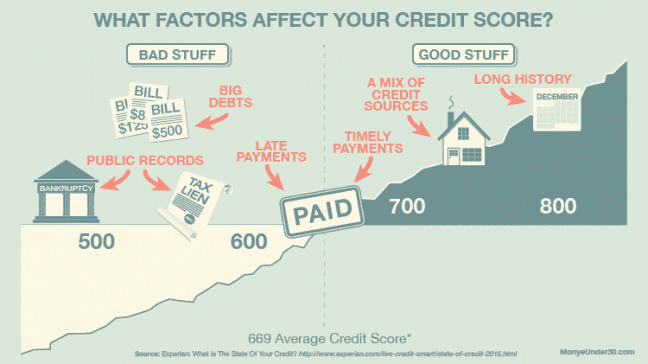

People with 760+ Credit Scores are likely to get the best mortgage rates. This score can be achieved in many ways but consistency and commitment are the keys. This means that you pay your bills on time, and use your credit responsibly. It's important to keep track your progress. It's a good idea for you to keep track with a credit score tracker, such as WalletHub.

For the best mortgage rates, lenders will consider your FICO credit score. In the past borrowers with credit scores of 720 and higher were most likely to be eligible for the best mortgage rates. Lenders are now requiring that borrowers have minimum credit scores of 740 and 760 in order to be eligible for the best mortgage rates.

720

At least 720 credit scores are required in order to obtain the best possible mortgage rate. You can get the best rates and terms if you improve your credit score. An increase in credit scores can help you qualify for a better underwriting group.

In the past mortgage rates were not available to everyone. Today, most lenders require a credit score of 740 or 760. However, a lower credit score will not have a significant impact on your application.

620

For the best mortgage rate, it is recommended that you have a minimum of 620 credits. Remember that different mortgage programs may require different credit scores. A government-backed mortgage may require a lower credit score than a traditional mortgage or vice versa. A mortgage loan officer can help you determine which mortgage option is best for you.

Most lenders use VantageScore or FICO scoring models to determine whether a borrower is creditworthy. These models take into account factors such as credit card balances or debt-to-income ratios. Those with a credit score below 620 can expect to pay a high interest rate, but a low score can still get you approved for a mortgage.