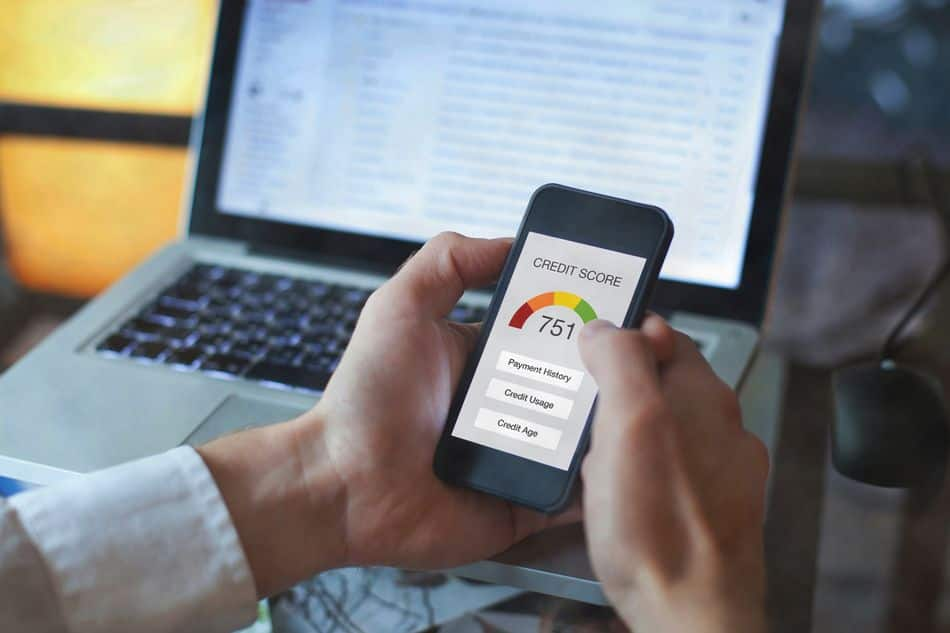

Credit scores are calculated based upon a variety factors, including credit utilization ratios, interest rates and length of credit histories. These factors make up about 30% of your total score. A high credit utilization rate can negatively impact your score. However, there are ways to reduce this amount.

30% of credit calculations are influenced by credit utilization ratio

Your credit utilization is an important aspect of your credit score. This can make the difference in whether you get approved for loans or not. You can improve your credit utilization rate by paying off all your balances each month. Find out how much of your credit is being used. LendingTree offers a free credit score tool to help you determine how much of your available credit is being used. It's free and will give you your credit score, as well as the amount you owe.

You should limit your credit to no more than 30%. The exact amount will depend on your financial situation. Your score will rise if you only use 30% of your credit available. Schulz suggests that you keep your credit card balances at 30% of the maximum. Keeping your credit cards at a minimum balance of $300 per month will improve your score.

Credit score calculations consider different types credit accounts

Credit score calculations take into consideration a wide range of factors, including your number and type of credit accounts. Your credit history, as well as the number of revolving loans you have, can impact your credit score. Revolving credit accounts are much easier than installment loans. This is why it is so important to only open accounts that you absolutely need. Examples of installment loans include auto loans, mortgages, and student loans.

Your credit score can be positively affected by having multiple credit accounts. This can demonstrate to lenders that you are able manage various types of debt. However, if you're opening a lot of new credit accounts, this may be an indication of risky behavior. The higher your credit score, the better your credit mix will be.

Credit score effects of high credit utilization

Credit utilization ratios that are high can adversely impact your credit score. You can avoid a drop on your credit score by making large purchases as quickly and efficiently as possible. So that high credit utilization does not get reported to credit bureaus it should be paid off before the due date. This is especially important in case you are looking to get a new credit line or maintain your best score.

Another way to decrease your credit utilization is to get a personal loan to cover large purchases. These loans are essentially installment loans with fixed rates and a predetermined repayment schedule. Personal loans, unlike credit cards can be used however you wish.