There are many myths surrounding credit scores. One is that closing credit cards with high interest rates can hurt your credit score. Another one is that parking tickets and fines are not reflected on your credit report. It is important to know that credit scores will not be affected by co-signing for credit card applications.

High interest rates can adversely affect credit scores by closing credit cards

You should not close your credit card with high interest rates if you are tempted. There are steps you can take to avoid the negative consequences of closing your account. To avoid closing your account, you should first pay off your entire balance and cancel any recurring charges. After you have done all of this, contact the card issuer to confirm that the balance is zero. Keeping a close eye on your three credit reports is also recommended.

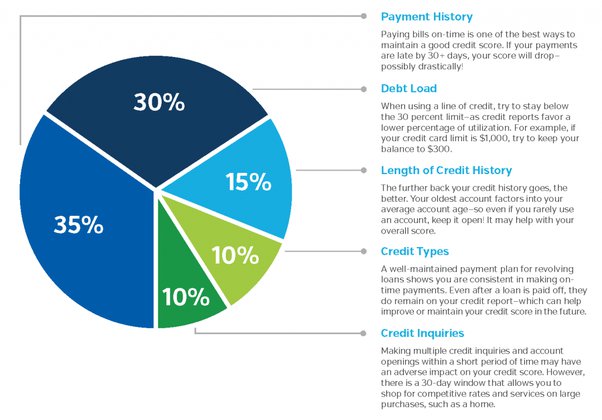

A decrease in your total credit available is one of the biggest ways closing a creditcard with a high interest rate can negatively affect your credit score. Your credit score is inversely proportional to how active your credit card accounts are. Because lenders want to see proof that you have managed your credit responsibly over the years, this is why. Your credit score will be significantly lower if you close a credit line that has been open for several years.

Parking tickets and fines are not recorded on your credit reports

Even though parking tickets or fines don’t appear on your credit report, it can still impact your driving record. Also, state and municipal governments have a long record so they may not be sympathetic to people who aren't paying their dues. Failure to pay the ticket could result in your vehicle being impounded or your driving record being removed.

Your credit score can be affected by parking tickets and other fines. This could also affect your ability to get car insurance. Car insurance companies need to see proof of a clean driving record. These records provide information about a person's motoring history, roadside accidents, and other incidents. They are an historical account of the time spent behind your wheel.

A lot of credit cards can lower the average age for your accounts

Open a lot credit cards to lower the average age of your accounts. You should only open too many credit accounts if you plan to use them for a long time. You can avoid this by limiting your choices to only one or two credit cards. Closed accounts are another way to shorten the average age of your accounts. Lenders may close your accounts after you repay a loan.

Don't rush to open a new credit card if you are nearing the end of your credit cards. While opening a card can help you in the short-term it won't fix long-term problems like undersaving and overspending. Instead, focus on maintaining a balance and being consistent with your payments.

Co-signing is not a factor in your credit score

Although co-signing for loans with your partner may sound like a great idea, it can also cause you problems. It's not only dangerous from a financial point of view, but it could also lead to problems in your personal life. You might consider getting professional help if you aren’t ready to take the risk.

Cosigning for loans isn't necessary, but it's a great way to help those with poor credit. You'll be able to get lower interest rates and pay less fees if this is possible. However, you should know exactly what is required of you before signing.