You'll find out about the Variables that can impact your credit score. This article will also teach you how to use credit score simulators and how to improve your score. The accuracy of a credit simulator will also be discussed. This information is intended to help you make wise financial decisions.

Credit score influenced by variables

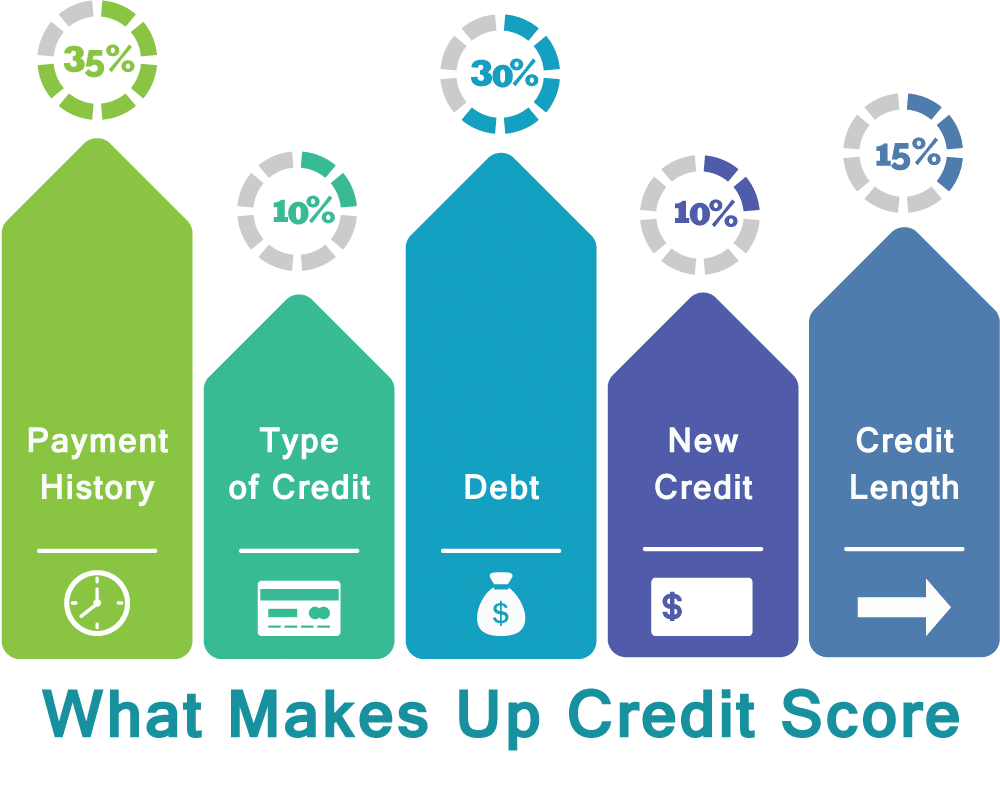

Your credit score can be used by lenders to determine your financial responsibility. It can range from 300 to 850. There are five main variables that affect your credit score. If you want to improve your score, you must be aware of these factors. These include bill payments, credit card balances, and auto insurance rates.

Your credit score can be improved by using your credit responsibly. Balances that are under 30% are a good indication of responsible use of credit. Having a mix of credit accounts that vary in type and tenure is a smart strategy.

How to use a credit score calculator

Credit score simulators can be very useful in monitoring your credit. It can help you decide which kinds of loans are better for your financial future. You might decide to apply either for a $10,000 loan or one that is $30k. Each option will have a different impact upon your credit score. However, you can view the effect of each option before making a decision by using a credit scoring simulator.

You will first need to enter your personal information in order to use a credit score calculator. For example, you will need your full address, name, date and birth. These details will be used by the company to calculate your credit score. This information could vary depending upon the type of account that you opened and the frequency with which you paid your balances.

Simulator of credit scores accuracy

Credit score simulators are not 100% accurate, but they can help you understand your credit score and prioritize actions. These programs can help you improve your score and prevent it from being damaged. Credit score simulators can also help you recognize when you've done something wrong or should be doing something better.

The accuracy of a credit score simulator is largely determined by the number of variables. A credit simulator can only give you an idea of how your credit score will change over time because credit scoring models are different from one bureau and another. A credit score simulator can help to understand how certain actions will affect your credit score, such as opening new credit cards or making late payments.

Using a credit score simulator to improve your credit score

A credit score simulator will help you track your credit score and identify the best actions to take to improve it. Credit score simulators can help you determine your current credit score and project it in the future. They are also useful for answering questions you may have about your credit.

Simulators make use of mathematical algorithms to predict your credit score. These simulators are not perfect, and a few factors may influence your actual score. One example is that the reporting period for a payment on a credit card can vary by as much as 30 days while bankruptcy declarations can stay on your record for up to ten.