It is up to the individual to decide how many credit cards they should have. It depends on your financial situation and the way you manage your credit. Your credit score also depends on it. Credit score plays a significant role in your ability to get a mortgage or to purchase large-ticket items.

Avoid applying for too many credit cards at once

Credit can be damaged by applying for too many credit cards. One inquiry will decrease your score five to ten percent, while multiple inquiries can result in a drop of up to three times your score. Multiple inquiries may raise red flags to lenders. Many will see multiple applications for credit cards as an indication that you're overextending yourself and could be a financial risk.

Do not apply for a new card if you have an existing credit card. Applying for too many cards will harm your credit score, and make it harder to get approved for credit. Keep your old credit cards open. Lenders appreciate a long history in credit. It's better for credit scores to have more than just one account.

It is hard to apply for too few credit cards at once. Not only does it hurt your credit score, but it also makes you appear to be a risk to other credit card issuers. This can make it appear that you are a high-risk credit hazard and is more likely to end up in debt. Furthermore, multiple applications may lead to multiple hard inquiries on your credit report, which will negatively impact your score.

Do not have more than 2 credit cards

While it may seem attractive to have multiple credit cards, many people find that having too many can cause problems. Your financial situation, spending habits, and credit history will all play a role in determining how many credit cards you should have. Keeping an eye on balances and payments is important, as is paying the balance off each month in full. To ensure you don't accumulate late fees, it is a good idea to review your credit reports.

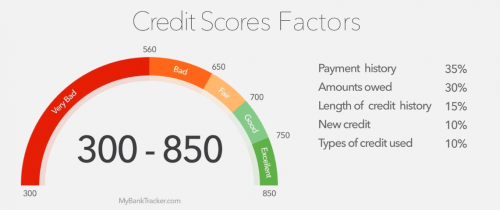

To avoid interest fees that can damage your credit score, it's crucial to pay your balance each month. You can also pay more than the minimum on your cards to improve your credit score. Your credit utilization ratio (also known to be total credit-to–debt ratio) is a key factor that can influence your credit score. Therefore, it's important to keep it under 30%.

Do not accumulate too many secured card

Secured credit cards come with many advantages but also drawbacks. There are some that charge a high application fee and a large annual fees. It is crucial to compare interest rates to determine the one that best suits your needs. Also, while a secured account may have a low credit limit you can increase it by making regular payments. Regardless of the card you choose, make sure to pay off the balance in full each month. This will help keep your credit utilization rate low and avoid paying interest.

While secured credit cards can boost your credit score, it is unlikely that you'll get past a certain threshold with sole reliance on these cards. These cards are difficult to keep your credit utilization low because they have a lower limit. However, secured credit cards are usually the only credit cards available to you when you're building your credit history.