A credit report is a record that shows a borrower’s track record of responsible debt repayment. A credit report can be used to help you obtain a loan or pay for a car. It can also help you determine if you are a credit risk. How to read your credit report is key to getting the most accurate information.

Equifax

Numerous consumers may have had an Equifax credit score mistake this spring. This error can impact your credit score which could result in you not being able to borrow or get credit. This could also affect your interest rates and fees. Most people didn’t notice any difference in scores. Some did notice a shift of 25 or more points.

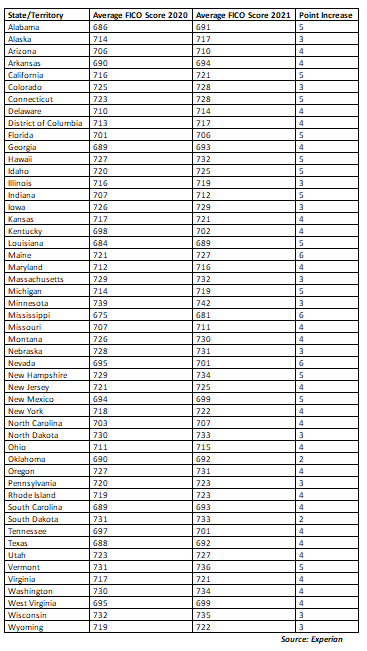

Experian

Your Experian credit report contains information from public records and credit grantors. Your Experian credit report will contain information from public records and credit grantors for up to seven years. However, Chapter 7 and 11 bankruptcy filings may continue to be on your records indefinitely. Even if you pay off your debts in full and on time, you may still find some disputed information on your report. Experian investigates disputes and removes unverified information from your report. Any requests to your credit history will remain on your report for a period of two years.

TransUnion

TransUnion's credit report will include information about credit history. Accessing your TransUnion credit reports is a good idea for many reasons. They will give you information about your credit history and help you decide which options you have. These credit bureaus store your credit files. They can help determine if you have good or poor credit.

Credit report information

Your credit report contains a variety of information about your financial status. It includes information about your creditors as well lenders. Reports usually include your full name as well as any alternative names that you might have used in the past. You should always check your report before applying for a major loan. To dispute inaccurate information, contact the credit bureaus.

Variations in credit report data

Variations in credit data can result from a number of factors. Different bureaus collect information from different sources. They may assign different weights or different weights depending on credit behaviors. It is possible that your report contains missing information, or it could be incomplete due to the slow reporting of credit bureaus. These cases are why it is important to reach out to the credit bureaus.

Credit Score Impact from negative items

A negative credit report can negatively impact your credit score. This can prevent you from obtaining credit cards or loans. You may also be charged higher interest rates. In order to determine your premiums insurance companies may also use your credit history.