Secured credit cards are credit cards that require you to make a refundable deposit before you can use them. These cards can be used to help you get an unsecured credit card. A secured credit card will require you to make a minimum deposit. You should be careful about how much you spend. Spending on these cards should be limited to a small number of purchases per month. Also, make sure that you pay your bills on time.

Secured credit cards require a refundable deposit

You can apply for a secured creditcard if your credit score is good and you are prepared to make a small deposit. A small deposit of $250 can give you greater control over your cash flow than a larger amount. The security deposit can't be refunded, so it could prove difficult for you to access it in an emergency. Additionally, if you aren't able to make your monthly payment, you might have to cancel the card.

Secured credit cards are a good option if you have bad credit or no credit at all. Although these cards do not require a credit check to be approved, some may charge more. For a refund to be issued, the card issuer will need your bank information. In certain instances, the issuer will grant you a statement-credit for your new Unsecured Card.

They can be used as a starting point to an unsecured credit card

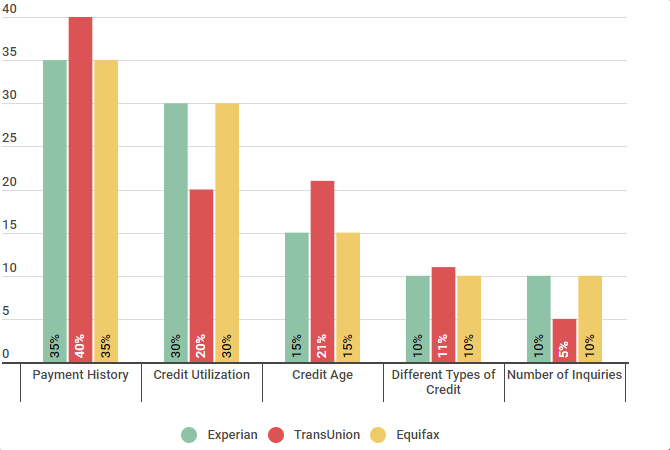

By making regular payments to your secured card, you can upgrade to an unsecured card. This will improve your credit score, which will allow you to be approved for anunsecured credit card by your card issuer. A credit score of at most 580 is a good goal. Additionally, your credit utilization ratio should be less than 30 percent.

Secured credit cards help you establish credit and teach good credit habits. They are not an ideal way to repair your credit. Many people eventually upgrade to an unsecured credit card.

They are a proof that lenders need good credit history

Secured credit card cards are one of many ways to establish your credit score. A majority of secured card issuers will refuse to issue you a credit card if your income is low or you've had bankruptcy. Bankrate's CardMatch tool can help you determine if you are eligible for one.

After making regular payments, some secured credit cards will automatically increase your credit score. This will increase your purchasing power as well as raise your credit score. Lenders will consider a FICO score of 670 or above "good."

They are much more easily accessible than unsecured credit cards

A secured credit card can be a great option for building credit. It is easier than unsecured cards and will help you build your credit. The issuer of these cards will require you to make a deposit. This is in order to cover any charges incurred if you fail to pay the bill. These cards are also better for people with bad credit, since they can help rebuild their credit history over time.

Unsecured cards may be harder to get and are more risky. Bad credit or no credit may make it more difficult to be approved for even a small line. Also, there may be high non-refundable charges. You could end up with an Account with an Annual Percentage Rate (APR) that is higher then your credit score.

They can help to build credit

Secured credit cards are a great way to start building a good credit history. These cards will report your monthly data to the credit bureaus. This will help you build a positive credit history. A secured card can help you build credit by making timely payments and not missing any payments. Your credit history will grow faster the longer you keep it open.

If you know how to manage secured credit cards, they can help you build credit. Pay your monthly bills on time, and don't spend beyond 30% of your credit limit. If you are struggling to build your credit, secured cards can be helpful. They report to the credit bureaus each month and have low annual fees. You don't need to deposit any money or pay an annual fee for the best secured credit card.