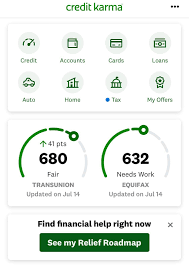

You are not the only one looking to improve your credit score. Increasing your credit score is essential for many things, but it can be difficult to know where to start. Luckily, there are some methods that can help you build credit quickly. These include making timely payments, applying to several credit cards and borrowing a loan in order to build credit.

Making on-time payments

Your payment history plays a major role in determining how credit scores are calculated. It makes up 35 percent of your credit score. You should make on-time payments as much as possible. Automated payments are the best way to do this. These automatically debit your bank accounts before the due dates. You don't have any additional money to cover the payment.

A personal loan is another way to build your credit. This type of loan is not easy to get, but it can be very beneficial in building credit history. But, only borrow as much as you can afford. Your credit score is affected by missed and late payments.

Secured credit cards

You can build your credit by getting a secured card. This type of card requires you make a cash payment as collateral. In return, the card will be allowed to be used for purchase. Late payments may result in the issuer removing your deposit.

Your credit score will rise quickly when you use a secured card. If you keep your balance low and make your payments on-time, you will see a rapid improvement in your credit score. You may be eligible to transfer to an unsecured credit card that offers lower fees and better rewards if your credit score is good enough.

Multiple credit cards

Multi-credit card applications can be a good strategy, regardless of whether you are rebuilding or building credit. Most credit card applications require the same information as for your birth date and Social Security number. After that, you'll need to go through several stages including a credit screening. Here are some tips to keep in mind while applying for new credit cards. First, make sure you provide as much information to the application as possible.

Multiple credit cards may be a good way to improve your credit score. It may lower your score if you make too many inquiries and have too many high balances on your cards. Additionally, you could end up with a higher utilization than you can handle by accumulating too much debt.

Take out a loan to improve credit

Many banks and credit cooperatives offer loans to individuals who want to improve credit histories. Remember to report these loans to the credit bureaus. You should not borrow more than you are able to pay back. Also, if you're building your credit by taking out a personal loan, you should make sure to make all of your payments on time. Failure to make payments on time can lead to a decline in credit score.

A good credit rating can help you obtain new credit quickly and at the most attractive rates. Although it can be challenging to improve your credit score, it is not impossible. Building credit takes time. Keep your score high by being organized and timely paying.