When applying for a mortgage, credit history is a crucial factor. Credit history not only provides lenders with information about your income and payment history but also reflects your quality of payments. You may not be eligible for a mortgage if you have negative credit history. A home loan is only possible if you have at least two consecutive years of good credit. Negative credit entries like vehicle repossessions, late payments, and home foreclosures will remain on your credit report for seven year, regardless of whether you have paid the balance.

Average age accounts (AAoA).

When determining your mortgage eligibility, the Average age of accounts (AAoA) is an important factor. Your application may be denied if you have an excessively high average age for your accounts. This is due to the fact that your AAoA can be affected by the number and age of accounts you hold. Your AAoA can be reduced by closing out old accounts or opening new ones.

Your AAoA is based primarily on the oldest and newest accounts in your credit report. Your score will be lower the older your oldest accounts are. To determine your AAoA, review your credit report. It shows all your open accounts and the dates they were opened. Calculating your average age of accounts is as easy as taking the average of two oldest accounts and multiplying it by the number open.

VantageScore

Your credit score is dependent on several factors including your payment history as well as your age. Another important factor is the length of your credit history. The longer it is, the better. Your score will rise if you use your credit responsibly. VantageScore emphasizes that longer credit histories are preferred by lenders.

Your credit score will improve if you pay all of your bills on schedule. You can set up automatic payments or reminders to remind you to make sure you pay on time. Be sure to inform your lender if you suspect you will be late. Most lenders won't report missed payments to credit bureaus if they are notified in advance.

FICO(r)

A FICO (r) score is a numerical rating indicating a borrower’s creditworthiness. The score is calculated using a credit report obtained from the three largest consumer credit bureaus. The score is calculated based on the payment history of a borrower, as well as the total amount of credit outstanding. When determining whether a borrower qualifies for a mortgage, the FICO(r) score is an important factor.

FICO scores are now required for mortgages by banks. VantageScore can be used in place of FICO. Although it can be used in a similar manner, VantageScore is used more frequently by investors to fund packaged consumer loans. It is also used by lenders in loan securitizations.

For VantageScore to give you a FICO(r), it requires that you have one month credit history

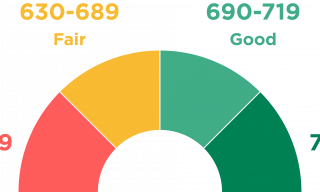

You should check your credit score first when looking for a mortgage. Low credit scores make it more difficult to get a loan. Two credit scoring systems can be used to determine your credit score: VantageScore and FICO. FICO is the standard score. It is the one you most likely will use. VantageScore was developed by the three credit reporting companies.

VantageScore analyzes credit data to generate a three digit credit score, ranging from 350-800. VantageScore is able to calculate your score even with a single month of credit history, unlike FICO. To be eligible for a loan with FICO(r), you must have at most one month credit history.

No credit history is required to apply for a mortgage

Even if you don't have a lot of credit history, you can still get approved for a mortgage loan. Bad credit means that you might have missed many payments or taken out too much debt. A negative credit history can include foreclosures and bankruptcy. While it can be more difficult to obtain a mortgage with poor credit than with good credit it is possible.

First, you will need proof to lenders that your finances can cover the upfront costs as well as mortgage payments. Credit will prove to lenders that you are able to repay the loan. This means you'll need credit history to start building credit.