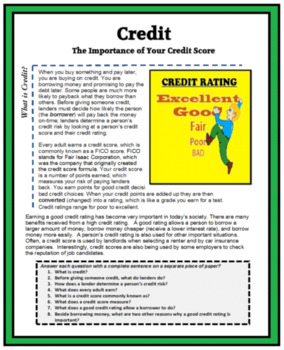

Good credit is important for many reasons. Good credit scores make you less risky than those with poor credit ratings or unstable credit histories. A second benefit of having good credit is that it can impact many areas of your life. From your ability receive certain services to your ability get housing. Third, credit can impact your livelihood.

A good credit rating can bring you many benefits

Good credit is essential to be eligible for many benefits associated with credit cards. High credit scores can lead to lower interest rates and more rewards. When determining your premiums for your insurance policy, companies also consider your credit score. A high score is a sign that you are less at risk.

You can use your credit for many purposes, including buying a home or a car. It can help you get a loan at a lower rate and make it easier for you to apply for work. It can make it easier to rent or lease apartments more economically if your credit is good. You might be eligible for a utility account with no security deposit.

Costs of having bad credit

Bad credit can limit your ability get loans and credit cards. Any loan with bad credit will come with higher interest rates. Lenders use credit scores as a way to assess risk and to decide whether you can pay back the loan. Lenders consider borrowers with lower credit scores higher risk as they are more likely default on their debts or to miss payments. The higher interest rate helps offset this risk, but it also limits your cash flow.

To get a credit cards, you will need to pay higher interest and deposit fees. You may also have to pay a higher deposit from certain utilities. Some utilities may also charge a higher deposit than others. You might not be eligible for premium plans or services. You can lower the costs of bad credit by learning how to improve your credit and stay on top of your credit score.

You can get a creditcard with a low interest.

A credit card account with a low interest rate may be possible for those with good credit. These cards are great for people who wish to keep a high level purchasing power but not pay a high rate of interest. If the current rate seems excessive, contact the credit-card issuer immediately to request a reduced interest rate.

Comparing offers from different lenders is the best way to find a low-interest card. Begin by reaching out to your bank/credit union to request a list containing credit card offers. Compare the variable APR and perks of each offer. You should also pay attention to foreign transaction fees.

A store credit card without a security deposit

There are a number of benefits to getting a store credit card with no security deposit. You can use the card to make purchases without having to pay a large cash deposit. Transfer the card to another bank account or credit card. Transfer fees and service charges will apply. If your credit score is low, it's a good idea to save up in advance for large purchases.

Low credit score customers can get store credit cards with special features. These cards offer cash deposit options, as well as the possibility to earn additional interest for money spent. Your credit score can improve if you make your payments on-time and repay any extra interest. A regular credit card is also possible once you have improved your credit score. Experts recommend that you avoid store cards with poor terms. Instead, choose a card that offers easy terms and allows you to enjoy shopping.