A credit score is a number that shows lenders how likely you are to pay back loans, such as credit cards or mortgages. This score is calculated by using the information contained in your credit file.

Your credit report contains all the information about your debts, how you pay them and any late payments. The information in your report can help creditors decide if you are trustworthy enough to borrow money from them and if so, how much they should charge you.

Your credit report may include information on your loan and payment history going back up to five full years. Your credit report will show you how much money is owed to you on your loans. This can include your credit card and mortgage balances as well. This includes your credit card and loan history, as well as any negative items like collections, bankruptcy or foreclosures.

Equifax Experian TransUnion, all three major credit bureaus will provide you with your credit score. Each of these bureaus has its own credit scoring model and uses its own calculations to determine your score.

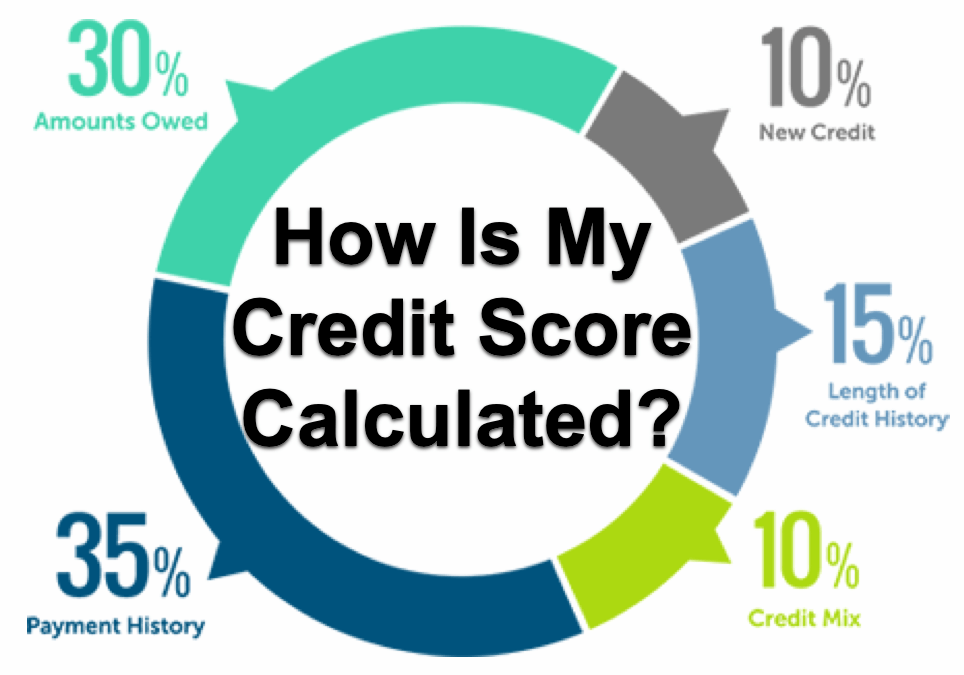

Credit scores are calculated based on the same factors. These include payment history, the number of types of credit that you have, and your credit history. The main difference in credit scores is how the various factors are weighted.

Payment history is the biggest factor in determining your credit score. It accounts for 35%. It is especially important to make on-time payments, as any late payments will lower your score.

Another factor that affects your score is your utilization rate, which refers to the amount of credit you owe compared to your total available credit limits. Paying off old bills and increasing your credit limits can help reduce your utilization ratio.

You may find that lenders are more willing to give you credit if you show a low credit usage rate. This is because they believe you will be a responsible borrower, who will pay back the credit card on time. Your credit history is also a factor, as are your credit mix and how many inquiries you make.

There are slight differences between the credit scoring systems used by the three main credit bureaus. FICO is given more weight than VantageScore which is a model that's newer and less sensitive to the credit utilization.

It is important for those with good credit to be aware that a large gap can exist between the score they receive and the one that they are given by their lender. It could be a difference of 20 points or a full score. It is most likely that the difference in scores is due to errors on your credit report which only appear on one bureau. It is best to check your credit reports for errors regularly.