You can build credit by using a credit card, provided you pay off all debt on time. Paying your bills on time and setting autopay are great ways to build credit. For credit cards to be successful, it is important that you maintain open accounts. Here are some guidelines:

Credit cards are a great way to build credit

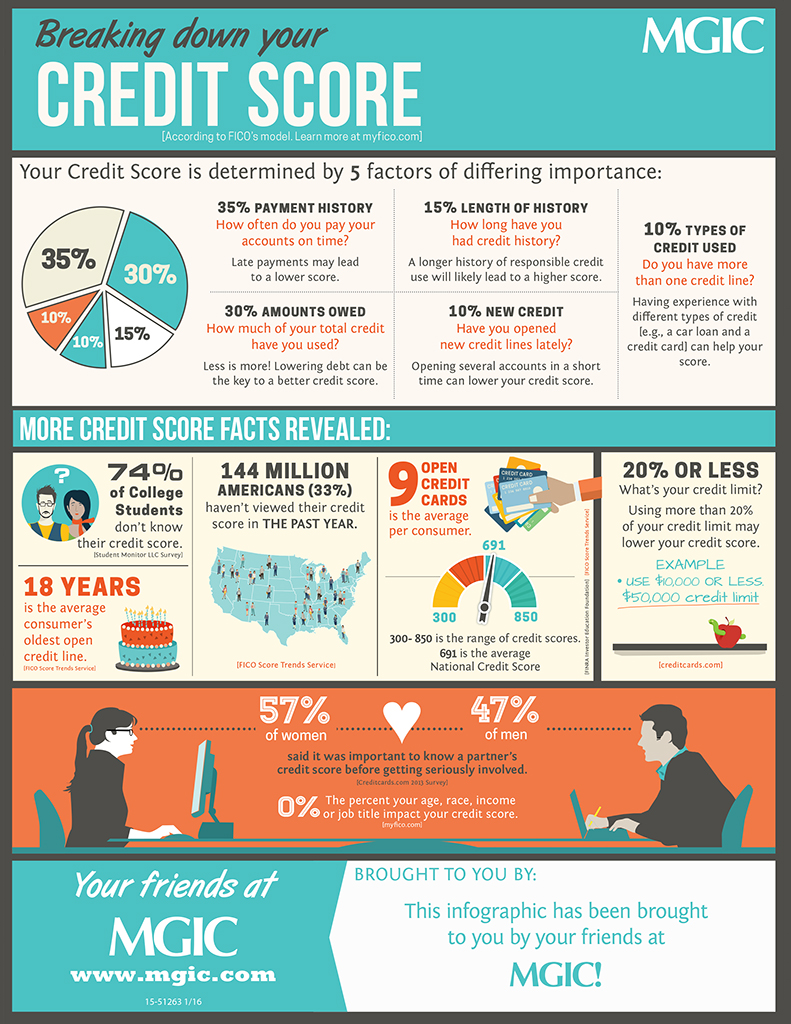

Using your credit card every month and making all your payments on time is the most effective way to improve your credit. You can improve your credit score by keeping your credit limit below 30 percent of the credit you have available. Set up autopay to pay for your purchases. This will automatically pay the minimum amount, giving you more spending flexibility. It is important to not go over your credit limit and end up paying more than you should.

A secured credit cards are a good option for those who are just beginning to build their credit. To get a secured credit card, you will need to deposit at least $200. After you get the card, you will receive a credit limit. This is typically the same amount as your deposit. Some secured cards require higher deposit amounts, while others do allow for lower deposits. It is important to be aware of how much money you must deposit in order to decide if you need a higher credit limit.

Paying off debt with a creditcard

Too many credit cards can cause you to feel overwhelmed and unprepared. Fortunately, you can begin to chip away at your debts by making smart money decisions. This article will provide information on several options for debt management. Continue reading to learn how to responsibly use credit cards and improve your credit scores. Also, consider speaking to a financial advisor to determine what strategy is best for you. These are some tips:

It is important to carefully read each credit card's terms and conditions before you use them to pay off your debt. These terms and conditions will be provided by the credit card issuer when you receive your card. This information is important to help you control your spending and make timely payments. While cleaning up your credit can be a lengthy process, it does not need to be difficult. While credit cards are a wonderful financial tool, be careful not to get into too much debt.

You can set up autopay for credit building with a Credit Card

You can set autopay to pay a monthly amount. However, it is important that you are able to cover the amount. Although you can normally set it to pay a fixed amount, you need to keep an eye on the balance of your account as overdraft penalties and return payments may occur if you don’t pay. Autopay has many advantages. It saves you time and money.

Autopay allows you to increase your credit score by automating monthly bill payment. Autopay can be set up through your company's billing system, or directly through your bank accounts. Autopay lets you pay your bills on time, helping you to keep good credit. Autopay gives you the opportunity to select a lower interest rate than the one you had been paying.

To build credit, it is important to keep accounts open

Creditors will find you more predictable the longer your credit history. This is why it is so important to keep your credit cards active. Closing your accounts can lower the average age your accounts and affect your overall credit score. Credit Strong will help you increase your credit history. These accounts are free to cancel and can accumulate 120 months of credit history. If you do not need them, it is best to avoid opening credit cards.

It's crucial to make all your payments on time. Missed payments will have a negative impact on your credit history. Late payments are reported by many financial institutions to the credit bureaus. This can negatively impact your credit score. Your credit card should not be viewed as a debit credit card, if you're trying to improve your credit rating. Instead, pay the entire amount every month to avoid incurring debt.