A credit card for 18-year-olds is a great option for young adults who have little credit history. Young adults have many choices when it comes to choosing a credit card product. In this article, you will learn about Capital One Venture X Rewards Credit Card, Petal 2, and Chase Freedom Unlimited.

Capital One Venture X Reward Credit Card

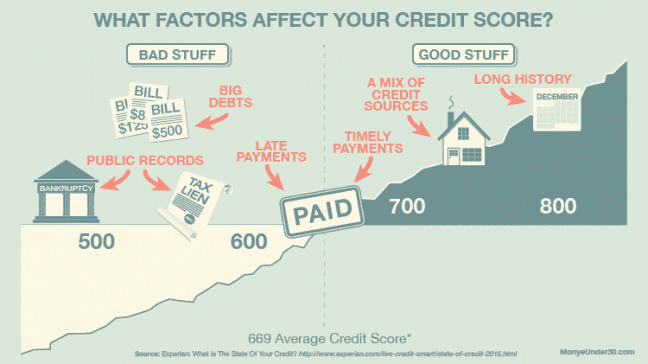

Consider the eligibility requirements when applying for credit cards. This type of credit card requires applicants to have a credit score over 740. But, approval is possible if your credit score ranges between 700 to 740. This credit card offers many great benefits.

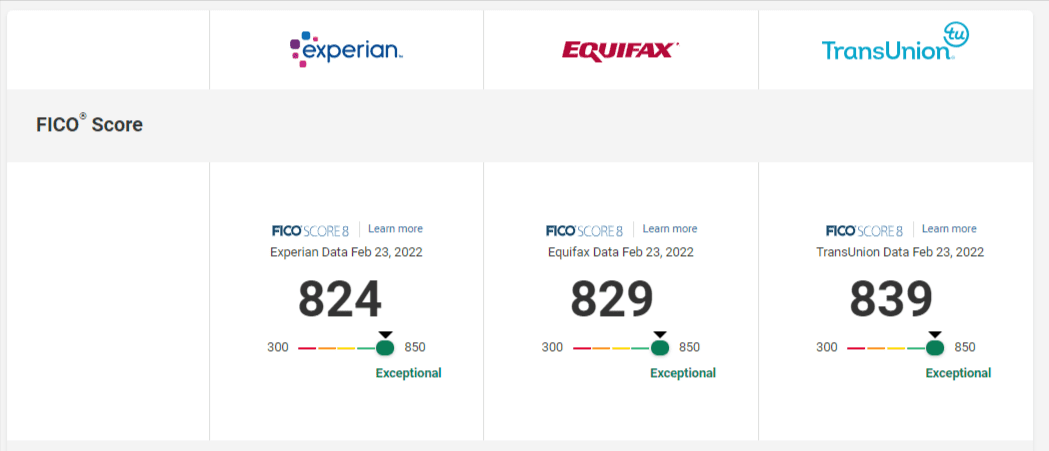

It is important to get credit reports from all three credit bureaus. Before applying, you will need to remove any credit freezes from your credit report. This is a practice that many credit card companies follow. Venture X rewards credit cards have some special features.

Capital One Venture X rewards card gives you twice the Capital One Miles on eligible purchases, as the name suggests. The annual fee for this credit card is $95 and it also features a Capital One Travel portal. It offers two complimentary lounge visits each year as well as 75,000 bonus points for spending $4,000 within three months.

Chase Freedom Unlimited

The Chase Freedom Unlimited 18 years old credit card offers an average sign-up bonus and lower rewards than premium Chase credit accounts. You might still be eligible if you are 18 years old with good credit. This card requires a minimum FICO credit score of 670.

The Chase Freedom Unlimited 18 year-old credit card can be a great option for people who are looking for a high cash-back credit card without paying a large annual fee. The card earns 1.5% cashback for all purchases and 5% on Chase travel and dining purchases. Other benefits include no annual fee and the ability to keep all of your rewards.

Chase Freedom Unlimited 18 year old credit card does not have an annual fee and has a low introductory interest. After the promotional period, your APR will rise to a high level. The annual fee is not required, however you will be charged a 3% foreign transaction fee. This card is ideal for anyone who plans to travel abroad. It also offers trip cancellation insurance and emergency assistance services.

Petal 2

Petal 2 credit cards are a great option for anyone 18 years old looking for a card. This card provides a high credit limit to those with poor credit. However, this APR is more than what you would see for credit cards. Missed payments could negatively impact your preapproval decision.

Petal Rewards and Petal Offers are two types of cashback offered by the Petal 2 credit cards. Petal Offers provides cash back on some purchases. Customers who pay on time will also be eligible for this bonus program. The amount that you spend will determine how much cash you earn at certain merchants. Cash back is automatically deposited in your Cash Back Wallet. It can be redeemed to cash in a check or statement credits.

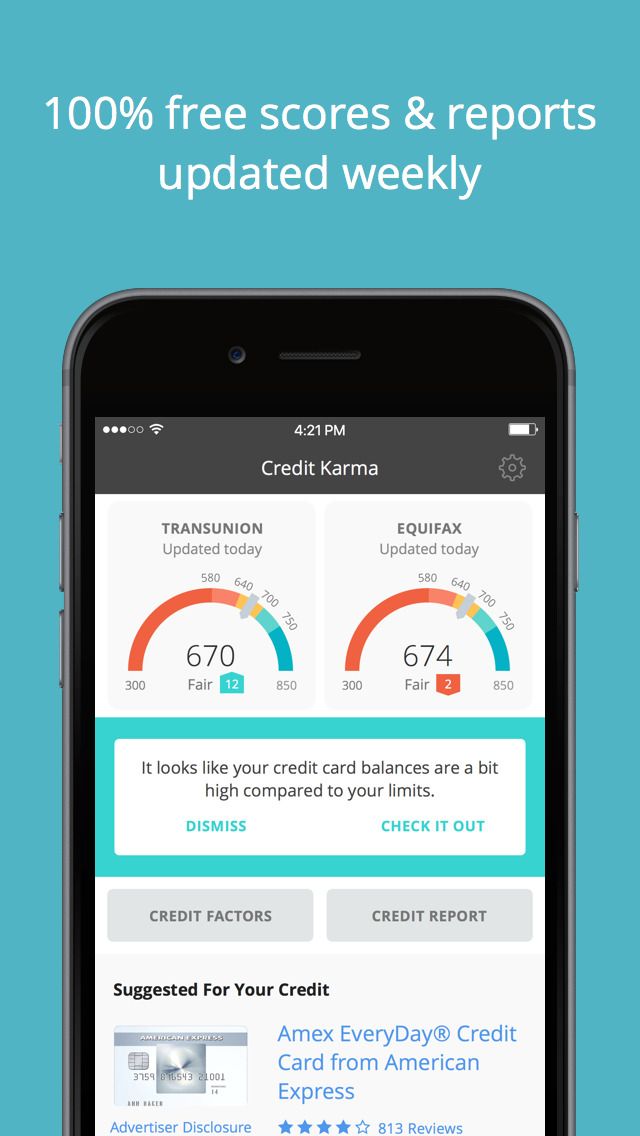

Petal 2 Visa Cash Back, No Fees Visa credit card is a great option for people with bad credit. The card gives cash back on eligible purchases, and allows for a credit limit of up to $10,000. Petal 2 credit cards offer many benefits. The app keeps track of your spending habits, improves your credit score, and offers cash back on eligible purchases. The mobile app lets you see your credit score and account amounts, along with payment due dates, rewards, payments, and more. You can also track your spending habits to improve your credit score.