A few things are important to remember if you want to know how long a close account stays on credit reports. Closed accounts are typically kept on your credit file for seven to ten more years. This negative mark will decrease your credit history, and increase credit utilization.

Closed since 7 to 10 years

It can be easy to overlook that a closed account is on your credit report. However, that information can have a negative impact on your credit. Inactivity can lead to credit card issuers closing accounts. If you want to keep your credit account open, it is important that you pay all due payments on time. Delinquency could result in your credit report being suspended for up seven years.

You can request to have closed accounts removed from you credit report. However, they are not required to do so. You can request the bureaus to remove closed accounts if you have a positive credit history and have long-term relationships with your creditors. It will not age as long as an account has been removed from your credit file. Most accounts will be closed for seven to ten if the account is in good standing. However they will stay on your credit report longer if it has an adverse credit record.

Credit utilization rates rise

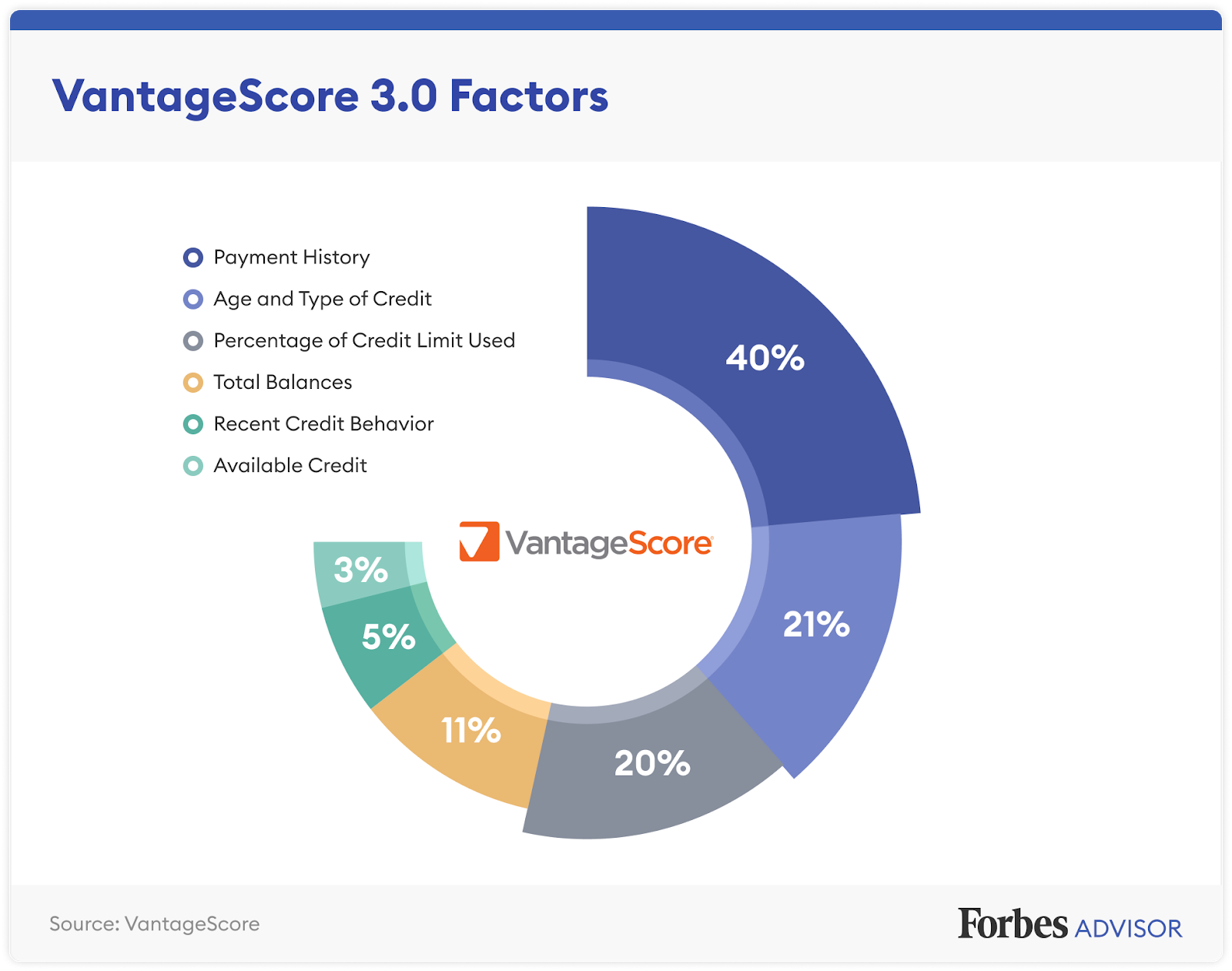

Closed accounts can increase your credit utilization rate, but this is not the truth. A common misconception behind this belief is that closed accounts don’t count towards credit age. A closed account can increase your credit utilization. This is because the debt on your closed account still remains, but it no longer acts as a cushion.

Although closing your credit card accounts can have immediate negative effects, it could also have long-term consequences for your credit score. High credit utilization rates are generally a negative sign. It is better to have a lower rate of credit utilization than to have more credit. A higher credit utilization rate also indicates greater risk to lenders.

Shortens credit history

Credit history length is one of the most important factors in determining your credit score. It accounts for 15% of your FICO(r). This is because lenders are more likely you to be creditworthy the longer your credit history. Be aware of these things when calculating how long your credit history is.

First, once you close an account, it will stay on your credit report for seven years. This may seem shorter than you would expect. However, late payments are permanent and will not be removed from credit reports until seven years have passed. The credit history of any closed accounts that have an unpaid balance will not be removed until that balance has been paid. A high balance account can still be closed and will negatively affect your credit score.

Negative marks remain on credit report for up to seven years

There are many ways to get negative credit information removed from your credit file. It is possible to dispute negative credit information with the credit bureau. This can take some time. Negative information stays on your credit file for seven to ten more years. Sometimes, negative information stays on your credit file for even longer.

You can ask the credit bureaus to remove negative information. However, they are not required to. If you have been paying your bills on time, the bureaus can remove closed accounts. Closed accounts are generally removed from your credit report after a certain period. If there are any adverse information regarding closed accounts, they can be kept on your credit report up to seven years.