A credit card balance is the total amount of money you owe to your credit card company. This can change from one statement into the next, or even from one day to another depending on how you use your credit cards.

Many credit card balances are different, which can make them difficult to understand. But it is important to understand the meaning of a credit balance and how it can affect your life.

Credit card balance means, definition and meaning

A credit balance is simply the amount owed at any moment on your credit cards. The balance is typically shown in your credit card bill or account summary.

You can use your credit card account balance to keep track and manage all of your financial transactions. Paying your credit card bill on time and in full will help you avoid interest and penalties.

Logging into your account on the web or using your mobile app will allow you to check your credit card's balance. Your balance and minimum payment will be shown.

This is the balance you owe. This number could be higher than what is on your statement, especially if purchases were made during the grace period for your credit card.

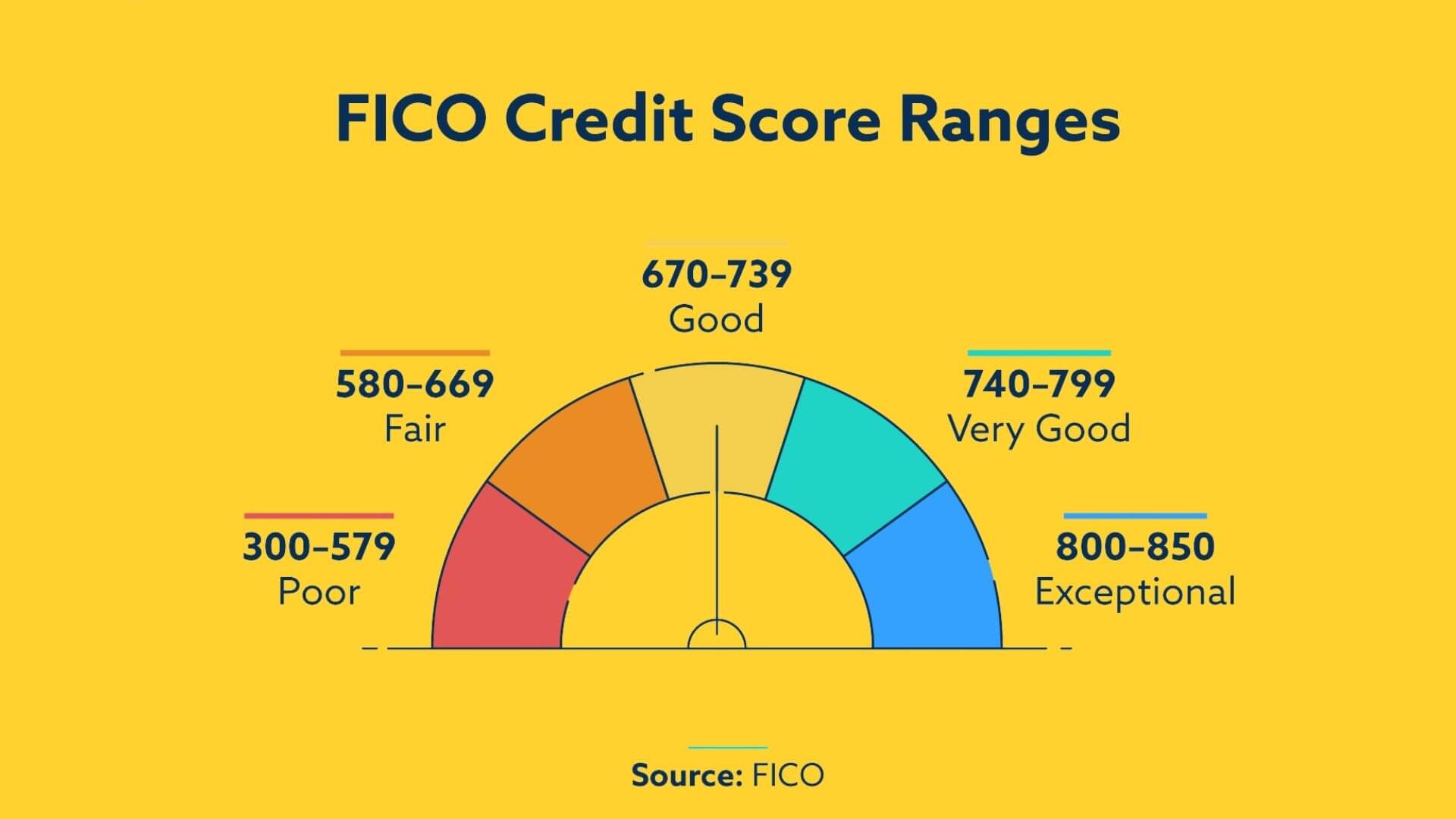

If you have multiple cards, the current balance can be useful for determining how much credit you have available to use on your other cards. For a good score, the balance of each card should not exceed 30% of your credit limit.

Your current balance will also help you keep track of your credit use ratio. That is, the ratio of how much credit you're currently using to the total available credit. This ratio can have a negative impact on your credit score, particularly if it's above 30%.

A credit card balance increases when you make a purchase on your credit card or charge something to it that exceeds your maximum credit limit. The additional charge is added to your credit card balance and can be used as a basis for calculating the amount you will owe in interest on your next billing cycle.

Your credit card debt will be reduced when you pay it off, which makes it easier for you to maintain the credit utilization and increase your score. You will also be able to see how much available credit you have and know when to increase your credit limit.

You may be able to transfer all or a part of your credit card balance to another. You can save time and money by doing this. Most credit card balance transfers are free.

The credit card balance can be confusing, but if you understand it, it will be easier to understand how to manage your credit and stay on top of your debt. The key is to learn how to budget, avoid interest and pay off your bill in full by the due date to avoid a lower credit score.