Credit history is an important factor when applying for a mortgage. It not only reflects the quality of your payments history but also gives lenders information about your debt-to income ratio. A negative credit score can hinder your ability to get a mortgage. Generally, you need at least two years of good credit history to qualify for a home loan. Negative entries, such as vehicle repossessions and late payments, will stay on your credit reports for seven years regardless of whether or not the account balance has been paid.

Average age of accounts

Your mortgage eligibility is determined by your average age of accounts. Your application may be denied if you have an excessively high average age for your accounts. This is due to the fact that your AAoA can be affected by the number and age of accounts you hold. By closing old accounts and opening new accounts, you can lower your AAoA.

Your AAoA is based primarily on the oldest and newest accounts in your credit report. Your score will decrease the older your oldest credit account. To determine your AAoA, review your credit report. It lists all accounts that are open as well the date they were opened. The average age of your accounts can be calculated by adding the oldest two accounts together and then dividing it by how many open accounts.

VantageScore

Credit scores are based on many factors, such as your payment history and age. A key factor is also the length and quality of your credit history. The better your credit history is, the longer it is. Credit management is key to improving your score. Lenders prefer people with longer credit history, and VantageScore emphasizes this fact.

You must pay all bills on time to improve your credit score. To ensure you do not miss a payment, set up automatic or reminder payments if you are unable to pay your monthly bills on time. Also, be sure to notify your lender if you know you will be late. Many lenders won’t report a missed payment on the credit bureaus, if you notify them in advance.

FICO(r)

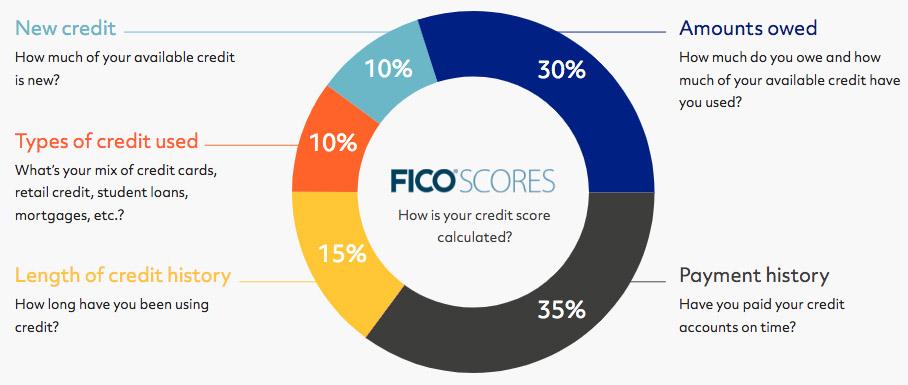

FICO(r), a numerical rating of the creditworthiness of a borrower, is what you call a FICO(r). The score is calculated using a credit report obtained from the three largest consumer credit bureaus. The payment history and total credit outstanding are the key factors in calculating the score. FICO(r), is an important factor to consider when determining if a borrower meets the criteria for a mortgage.

While banks have been requiring FICO scores for mortgages, they may soon face competition. VantageScore is an alternative to FICO. It can be used similarly, but investors are more likely to use it for consumer packaged loans. It is also used to securitize loans by lenders.

VantageScore needs one month's credit history to get a FICO (r) score

When shopping for a mortgage, one of the first things you should do is check your credit score. It is difficult to get approved for a loan if you have a low credit score. There are two credit scoring systems you can use to check your score: the FICO and VantageScore. The FICO score is the standard score, and it is the one you will likely be using. VantageScore, a more recent system, is promoted by the three credit bureaus.

VantageScore analyzes credit data to generate a three digit credit score, ranging from 350-800. The VantageScore score is not dependent on FICO. It can be calculated even though you have only one month of credit history. However, it is important to note that you must have at least one month of credit history to qualify for securing a loan with a FICO(r) score.

No credit history needed to obtain a mortgage

Even if your credit history is not great, you may still be eligible for a mortgage loan. Bad credit means that you might have missed many payments or taken out too much debt. Bankruptcies and foreclosures can leave a big blot on your credit report. While it can be more difficult to obtain a mortgage with poor credit than with good credit it is possible.

First, you'll need to prove to lenders that you can afford the mortgage payments and upfront costs. You can convince lenders that your credit history will help you repay the loan. To build your credit score, you will need to have a credit history.