So that lenders can see you as a responsible borrower, it's important to steadily increase your credit score. It is not possible to predict how long it will take to build credit. It is possible to estimate the average time, even though credit reporting agencies do not advertise this information. It will take more time to repair or reestablish credit than it would to build it from scratch.

Building credit from scratch

When starting a new credit history, it's essential to be patient and not make impulsive decisions. It takes time for a track record that shows good payments and prompt payments of balances. Late payments can adversely affect your credit score. You should also keep a buffer in your checking accounts and set up autopayments, if possible.

While building credit from scratch takes time, it is an important step to prove to potential lenders that the person you are is responsible. The time it takes will depend on several factors. These include your financial situation and the time you spend building your credit history. It also depends on how well you manage your debt. Here are some suggestions to help you get started.

Rebuilding damaged credit

Credit scores are an important part of your overall financial health, but if they have been damaged due to a financial mistake, it can take time to restore them. You can start rebuilding credit by following a few steps. To avoid too much debt, the first step is to not accumulate it. Credit scores will drop if your credit utilization rate is high. It is essential to pay down your credit card balances each and every month. Doing so will make your credit score significantly better.

While rebuilding damaged credit will take time, it will improve your financial situation and help you qualify for a variety of financial products. It is best to start by applying for just one secured credit card. Eventually, you may want to apply for two or more. It is important to remember that multiple applications can adversely impact your credit score. Therefore, it's best not to wait six months or more between applications.

Paying off credit card balances each month

Paying your credit card bills each month is an important step in building credit. Interest on balances that you carry over from month to month will start to accumulate immediately, so paying off your balance every month is essential to building your credit. You don't have interest for the amount you have, but most cards offer a grace period. To regain the grace period, if you don't make your payment within the grace period you will have to pay the entire balance within the next two billing cycles.

A debt management plan can help you to pay off your balances faster and more efficiently. These plans will consolidate your monthly bills and help you distribute them to your creditors.

With a secured creditcard, you can build credit from scratch.

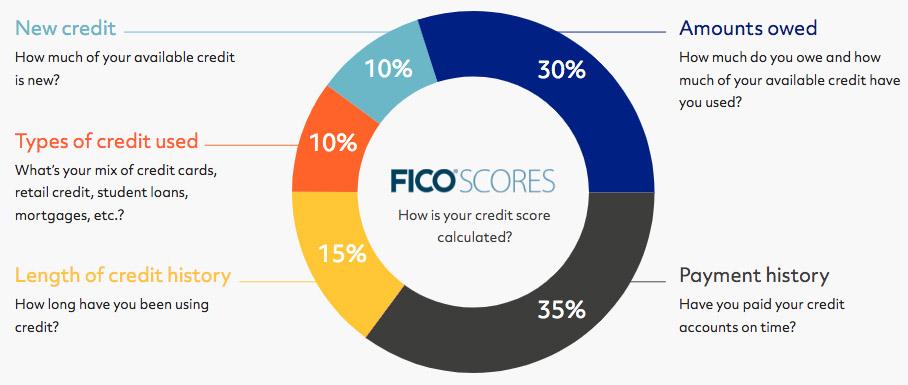

Secured credit cards are a great way for you to begin building credit. These cards require you to put down a certain amount of money upfront. Once you have the money, you can make purchases with it, provided you pay it back on time each month. Avoid carrying a balance. This can result in higher interest rates and lower credit scores. You can avoid this by purchasing only small items and watching your credit score closely. Credit scores are calculated on several factors including how long you've used credit cards.

One in ten Americans has little or no credit history, which means they cannot get a credit score. They will not be able access the financing products that they require to make their purchases without a credit history. Secured credit cards are a great option for people with low credit scores.

Personal loans are a great way to build credit right from the start

You might be in a difficult spot if you have never used credit. FICO Credit Score is a number of three-digits that financial institutions use as a measure of creditworthiness. This is why it is so important to build credit to be able borrow money in future. There are many ways to achieve this.

It is possible to build credit from scratch, even though it may seem daunting at first. If you are good with money, you can maintain your current credit score while pushing it up over time. Examining your credit report is the first step toward building credit. There are many free services that allow you to view your credit report.