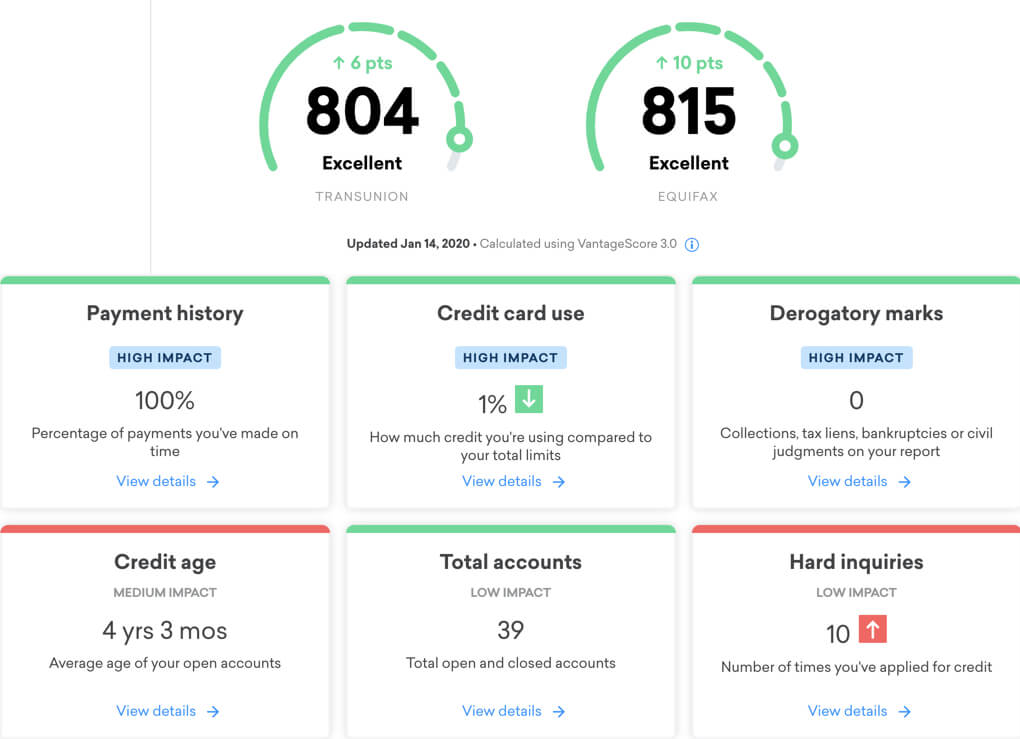

Credit score is affected by several factors. Your credit history, length of credit history with lenders, amount of debt, and type of credit are all factors. You can boost your credit score with a few simple steps.

Paying off a loan

High credit scores can help you pay off loans. But it can also harm your credit score. Your credit score is influenced by several factors, including the length of credit history and the amount owed. The average age of accounts is about 15 percent of your overall score, so paying off a loan with an older balance is bad for your credit. Paying off a loan that has a low balance will increase the credit used which can affect your credit score.

Credit history length

Having a long credit history helps your credit score. These information are used by lenders to help them make credit decisions. Lenders are able to check if payments were made on time and assess if the borrower can be trusted. Lenders will be more willing to lend to someone with long credit histories than someone with short credit histories.

Debt amount

The amount of debt a person has may seem like a major obstacle to achieving a high credit score. High debt does not necessarily indicate high credit risk. High debt can actually have a positive effect on credit scores if it is managed well. Recent research found that 36% said high debt does not negatively impact their credit scores as long as they are able to pay their bills on time.

History of payments

Credit scores are influenced by your payment record. It reflects whether you make your payments on time, how often you miss them, and how recently you've missed a payment. Your credit score will rise if you have a good payment history. It's important to pay all accounts on time. It will help your credit score if you make at least 90 percent of all your payments.

Impact of applying for credit on credit score

Your credit score can be affected by multiple credit lines such as a credit card. Multiple applications can lead to hard inquiries that could lower your credit score. It's better to apply for only one card and wait for approval. If you want to improve your credit score, you may also be interested in a personal loan.

Automated payments can improve credit scores

Automating your payments is one of the best ways you can improve your credit score. Automating your payments helps you to stay on top and avoid any late fees. If you've paid your bills on-time, this can make a difference in your credit score. But if you've missed a few, this can have a negative impact.